Macroeconomic Enviroment

Why Macroeconomic Environment?

Solid macroeconomic fundamentals reduce uncertainties about the future and increase investor confidence.

Price stability is a fundamental condition for sustainable growth processes. It must be accompanied by actions to remove institutional obstacles hindering increased public and private investment.

Controlling the path of the Brazilian public debt is fundamental to ensure economic stability in the medium and long term. The first steps in this direction were taken with the passage of the spending ceiling bill. However, without a pension reform and without better management of public spending, the spending ceiling will not be met and will become innocuous.

In order to improve Brazil’s competitiveness, it is important to promote favorable conditions for a significant increase in the investment rate, which remains lower than that recorded in other emerging countries, including in Latin American countries.

VISION FOR 2022

Brazil’s growth is underpinned by a consistently rising investment rate financed by increases in public and private savings. Competitive exchange and interest rates, with inflation under control, stimulate productive activity. Fiscal balance is achieved by containing public spending, which becomes gradually more efficient, contributing to a better provision of public goods and services.

How are we doing?

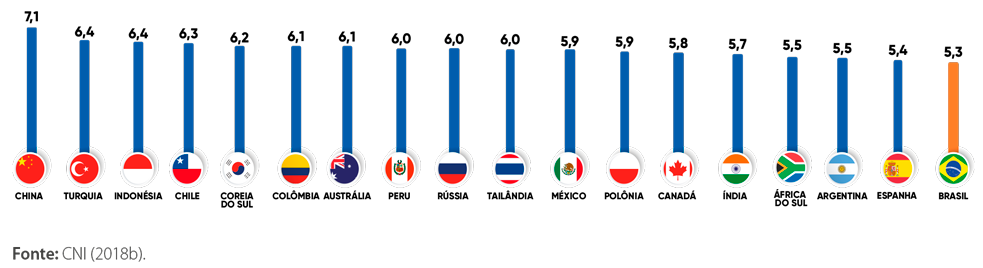

Brazil’s poor performance is reflected in the report Competitividade Brasil 2017-2018: comparação com países selecionados: Brazil was ranked last among 18 countries in the Macroeconomic Environment factor.

RANKING OF THE MACROECONOMIC ENVIRONMENT FACTOR

Where do we want to get to?

Main goal: Ensuring Brazil’s economic stability

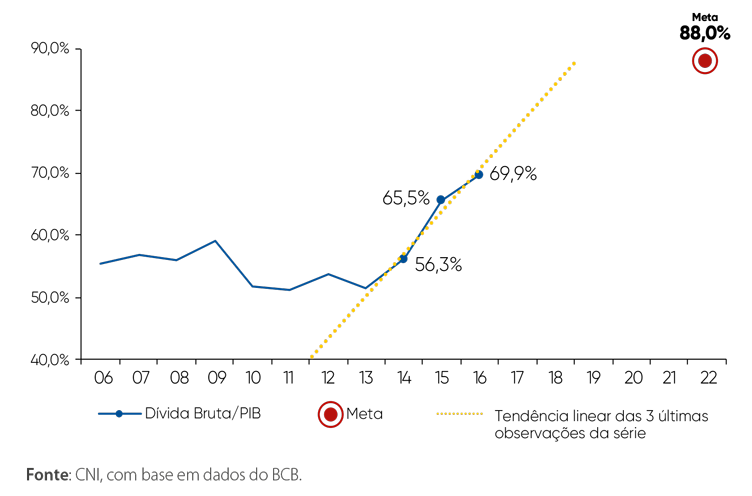

Macro objective: Keeping the debt-to-GDP ratio below 88%

DEBT-TO-GDP RATIO (BRAZILIAN GROSS DEBT AS A PROPORTION OF GDP )

PRIORITY TOPICS

STABILITY AND PREDICTABILITY

Balanced fiscal accounts are a key factor for ensuring stability and predictability in the macroeconomic environment and for improving the business environment

A predictable macroeconomic policy contributes to fostering private investment and to boosting the country’s competitiveness and growth rates. Macroeconomic instability discourages investment because it leads to uncertainties and hinders economic growth. The fiscal deficit limits the ability of the state to invest and stimulate demand. Inflation reduces real income and household consumption.

In the first half of this decade, inflation and interest rates evolved unfavorably and contributed to the recessive scenario faced by the Brazilian economy. This situation has been reversed, but the loss of macroeconomic stability has led to fiscal deterioration. Recovering balance in fiscal accounts is the main challenge to be faced to ensure lasting macroeconomic stability.

Keeping public sector spending within the set limit is essential. However, without a pension reform to ensure long-term sustainability, it will not be possible to achieve fiscal balance.

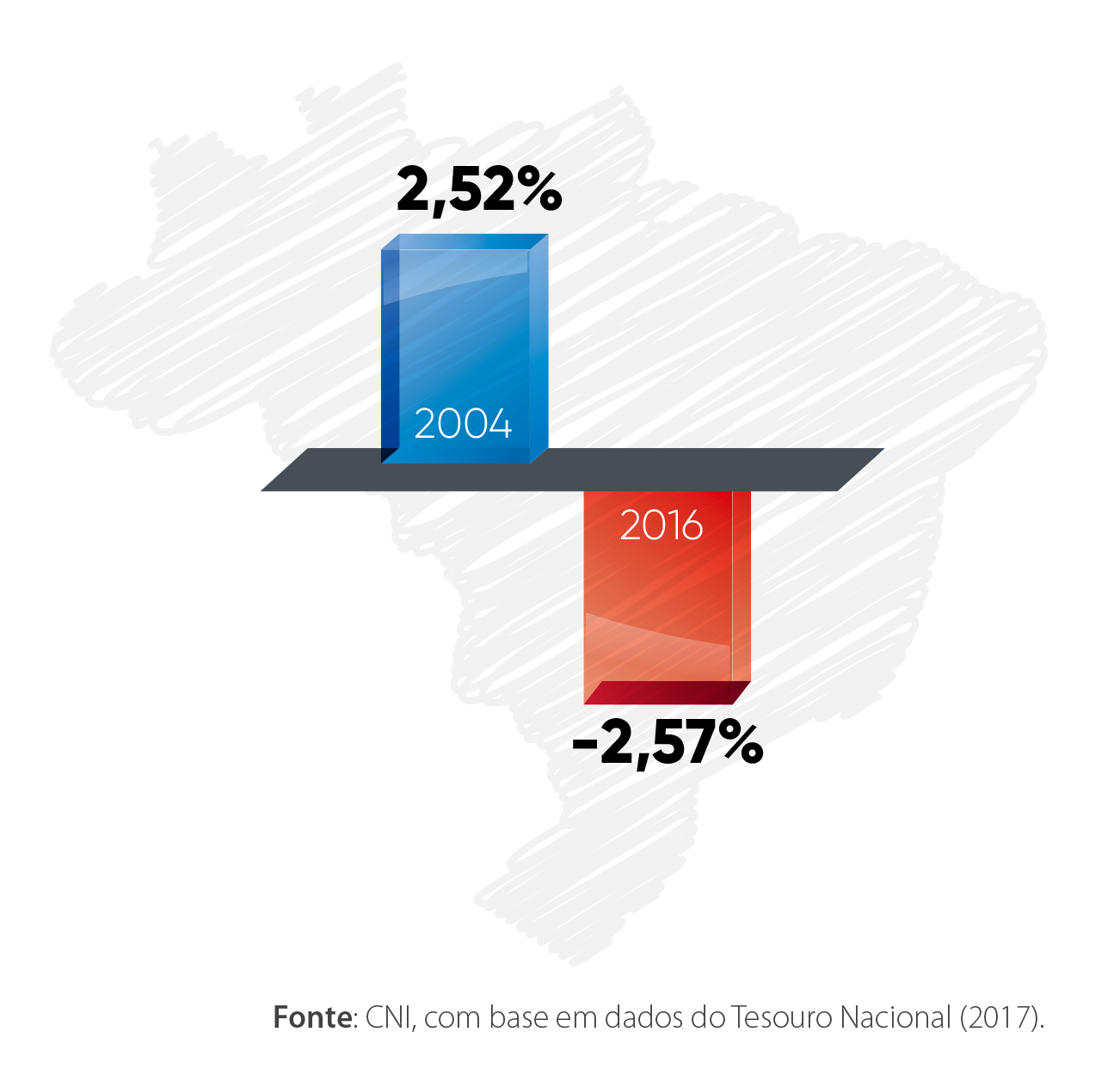

PRIMARY RESULT OF THE CENTRAL GOVERNMENT

Goals

Ensuring stability and predictability in macroeconomic policy

OBJECTIVE

OBJECTIVE

Keeping the inflation rate below 3.5% per year.

![]() INICIATIVES

INICIATIVES

- Keeping the public debt under control

- Keeping inflation within the target

- Reducing interest rates to international standards

Recovering and ensuring fiscal balance

OBJECTIVE

OBJECTIVE

Increasing the primary result of the public sector from -2.6% to 0.3%

![]() INICIATIVES

INICIATIVES

- Keeping public spending within its set limit

- Passage of the pension reform bill

INVESTMENT

Brazil has one of the lowest investment rates among emerging countries and improving this rate depends on the country’s ability to increase its domestic savings

Investment is a major determinant of the competitiveness of industry and of the country at large. High investment rates translate into improvements in infrastructure, technologically up-to-date machinery and equipment and more intense knowledge generation in companies.

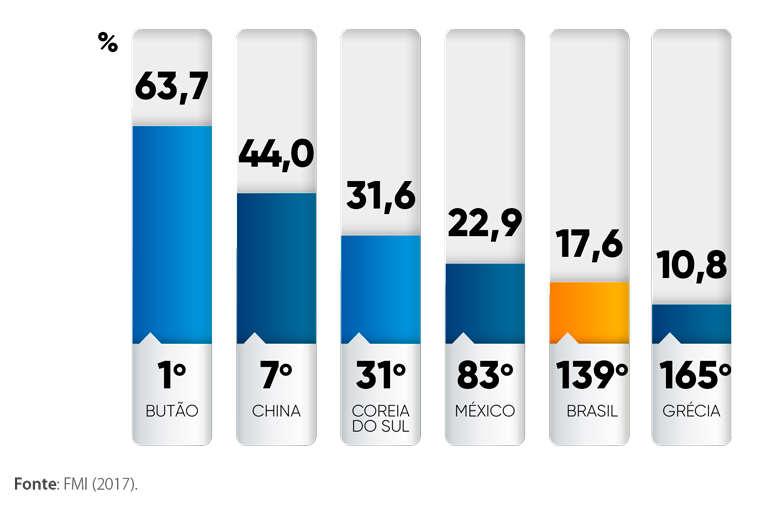

Brazil’s average investment rate is lower than the average rate recorded in other major emerging economies such as China, Mexico and Chile (IMF, 2017).

In order to grow, Brazil needs to increase its investment rate, but facing this challenge is difficult due to the country’s low savings rate. The alternative of financing investment by raising external savings is limited by the accumulation of external liabilities. Therefore, measures must be taken to increase domestic savings by reducing current government spending and stimulating household savings.

It is also necessary to reduce the cost of investment by eliminating the tax burden on fixed assets and reducing the cost of capital.

INVESTMENT RATE (2017 - IMF ESTIMATES)

Goal

Increasing the investment rate

OBJECTIVE

OBJECTIVE

Increasing the investment rate from 16.4% to 21%

![]() INICIATIVES

INICIATIVES

- Increasing the country’s saving capacity

- Reducing investment costs

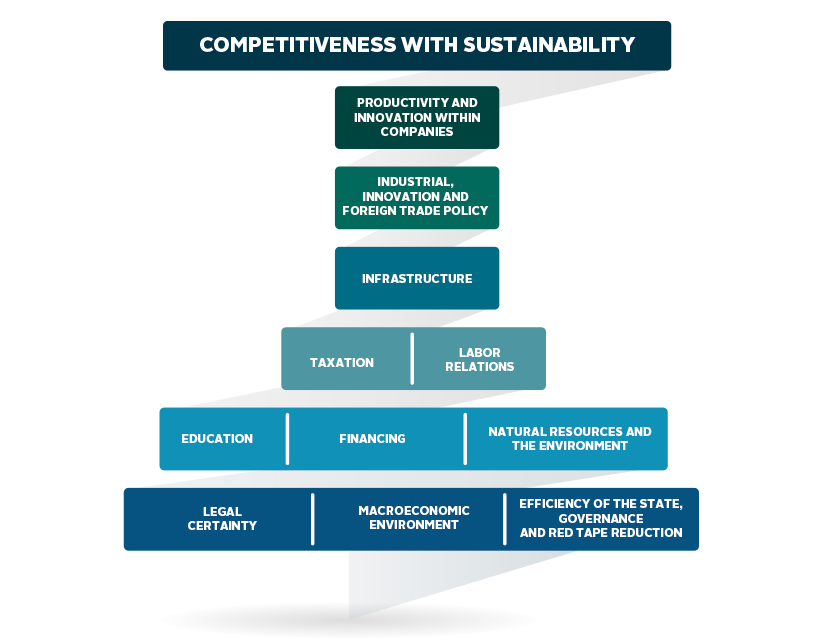

KEY FACTORS

Click on each key factor below to learn more about the Map